Investment Strategy

Investment Strategy

Published:

29.10.2025

Contact:

Financial Officer Anders GarriguesThe Carlsberg Foundation’s available funds are defined as investments and assets other than shares in Carlsberg A/S and certain properties. These available funds of around DKK 11.5 billion are invested in accordance with the foundation’s investment policy.

The purpose of the investment policy is to achieve an attractive long-term risk-adjusted return that is also balanced in terms of sustainability and enables the foundation to maintain and potentially increase funding for its four philanthropic objects.

The Carlsberg Foundation has appointed an investment committee to monitor and advise on the foundation’s investments.

General investment strategy

The Carlsberg Foundation’s financial assets broke down as follows on 30 June 2025:

The Carlsberg Foundation’s shares in Carlsberg A/S represent around 76 per cent of the votes in the company and around 29 per cent of its capital. Under its charter, the foundation must retain at least 51 per cent of the votes in Carlsberg A/S. The foundation’s remaining shares in Carlsberg A/S provide a buffer so that Carlsberg A/S can raise capital by increasing its share capital without the foundation exercising its pre-emptive rights and participating in the capital increase. The shareholding in Carlsberg A/S is not therefore covered by the foundation’s investment policy, but it is covered by the foundation’s policy on engaged ownership.

The foundation owns a small number of properties, of which the majority form part of its strategy for philanthropy. These properties are therefore also not covered by the foundation’s investment strategy.

The foundation’s investment policy covers only the foundation’s available funds (“other securities” in the table above), which had a value of DKK 11.5 billion on 30 June 2025. The investment policy sets out the foundation’s risk appetite, performance ambitions and processes for asset management and rebalancing.

The policy also requires part of the foundation’s available funds (around DKK 1.2 billion) to be available to meet the foundation’s short-term cash needs. This ultra-liquid portion mainly covers grants awarded but not yet disbursed.

The Carlsberg Foundation aims to achieve a long-term risk-adjusted return by limiting investment costs and spreading risk across different types of financial asset. It has therefore chosen an asset allocation based on strategic weights for liquid and illiquid investments.

The foundation has chosen to work with professional and renowned advisers and asset managers who have the skills and resources to monitor and ensure compliance with its investment policy and investment strategy. The Carlsberg Foundation does not itself participate in the day-to-day monitoring of the thousands of assets in which its available funds are invested.

Risk profile and investment costs

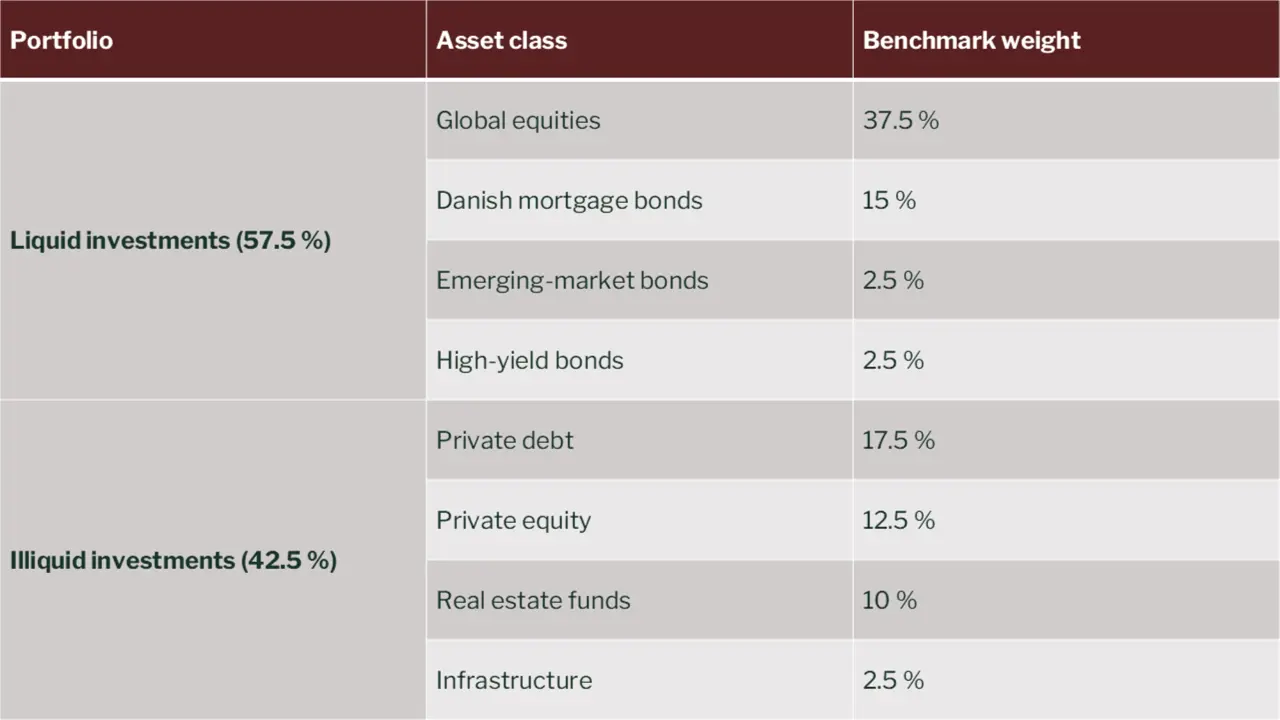

The Carlsberg Foundation’s target asset allocation is 57.5 per cent liquid assets in the form of listed shares (37.5 per cent), Danish mortgage bonds (15 per cent) and other bonds (5 per cent), and 42.5 per cent illiquid assets in the form of private debt (17.5 per cent), private equity (12.5 per cent), real estate funds (10 per cent) and infrastructure funds (2.5 per cent), as illustrated below:

As it will take time to achieve the target asset allocation (especially the strategic weights for illiquid assets), the foundation currently has a larger share of its investments in global equities and bonds than is intended in the longer term.

Highly diversified portfolio

The Carlsberg Foundation’s investment policy and investment strategy entail a high degree of diversification:

- Investments in shares are made primarily through global ESG-screened index funds, which means in practice that investments are spread across several thousand listed companies.

- Bond investments are typically in various types of bond fund, which also entails a relatively wide spread of investments.

- Investments in private debt, private equity, real estate funds and infrastructure funds are also made through funds which have numerous underlying investments.

The asset managers who select and execute the underlying investments are chosen following an in-depth analysis by the foundation’s investment advisers.

The Carlsberg Foundation aims to achieve a long-term risk-adjusted return partly by minimising investment costs, for example by keeping the foundation’s own resources at low levels, by avoiding performance fee agreements, and by investing in pools or funds through asset managers.

Historical performance

The return on the foundation’s securities holdings and liquid assets was DKK 1,410 million in 2024 and DKK 992 million in 2023. This breaks down into unrealised gains of DKK 1,345 million in 2024 and DKK 958 million in 2023, realised income of DKK 75 million in 2024 and DKK 37 million in 2023, and realised and unrealised costs of DKK 10 million in 2024 and DKK 3 million in 2023.

The return in 2024 was the highest in the foundation’s history and exceeded the year’s revenue in the form of dividends from Carlsberg A/S.

Ethics and sustainability

The Carlsberg Foundation believes that investing in companies that have set ESG targets and report on their progress on ESG issues – including respecting international principles for social responsibility – will be more sustainable and result in healthier long-term value creation and a higher risk-adjusted return, as well as having social benefits.

The foundation’s investment policy is therefore also designed to take account of sustainability considerations, and states that the investment portfolio is to be invested in companies that disclose ESG-related information and work with one or more of the UN’s 17 Sustainable Development Goals.

The Carlsberg Foundation expects its chosen asset management partners to be signatories to the UN’s six Principles for Responsible Investment (PRI) or have other external validation of their ESG commitment.

UN’s six Principles for Responsible Investment (PRI)

The six principles are: 1. We will incorporate ESG issues into investment analysis and decision-making processes. 2. We will be active owners and incorporate ESG issues into our ownership policies and practices. 3. We will seek appropriate disclosure on ESG issues by the entities in which we invest. 4. We will promote acceptance and implementation of the principles within the investment industry. 5. We will work together to enhance our effectiveness in implementing the principles. 6. We will report on our activities and progress towards implementing the principles.

This means that the foundation wishes its investments to be made in funds that integrate sustainability risks and take account of the most significant negative sustainability impacts in their investments. For funds covered by the EU’s Sustainable Finance Disclosure Regulation (SFDR), this means Article 9 funds and Article 8 funds.

The criteria applied when selecting and monitoring the partners who advise the Carlsberg Foundation and invest on its behalf include expertise in ESG, the sustainable transition and active ownership.

Article 9 funds: Funds that have sustainable investment as their objective and invest in companies or activities that aim to help solve some of the planet’s challenges and create a more sustainable world (dark-green funds). Article 8 funds: Funds that promote environmental or social characteristics but do not have sustainable investment as their objective (light-green funds). Funds not covered by Articles 9 or 8 are categorised by the EU as Article 6 funds. Article 6 funds are defined as those that give little or no consideration to sustainability in their investment decisions.

When it comes to investing in shares, the Carlsberg Foundation acknowledges that defining an ethical investment policy is a complex and ever-evolving process.

Since the foundation wishes to have broad diversification of risk, with equity investments spread across several thousand companies, it has decided to adopt the exclusion lists applied by the globally recognised financial experts MSCI, Northern Trust Corporation and Nordea.

The foundation has also chosen to invest in equity funds where the managers have the right resources and skills to monitor and ensure compliance with its requirements. The Carlsberg Foundation uses advisers to carry out analyses and assessments before selecting asset managers.

The asset manager's role

The Carlsberg Foundation’s advisers assist in selecting asset managers to execute and monitor its investments. These managers must meet certain criteria for skills and resources and be signatories to the UN PRI or equivalent principles.

The foundation has an ongoing dialogue with its advisers on how to ensure that the chosen asset managers comply with its requirements, and on how these asset managers should respond when individual companies are found to fall short of the desired standards.

In some cases, the asset managers will engage with the company’s management based on their policies on active ownership. In other cases, they may divest from the company.

It is therefore the foundation’s asset managers who handle the day-to-day monitoring of investments, based on the criteria prioritised by the foundation when selecting the managers.

The asset managers’ ongoing screening processes result in investments being added and removed, and the foundation’s advisers engage in dialogue with the asset managers on their work on monitoring and control.

The asset managers in turn engage in dialogue with a wide range of listed companies (either directly or via recognised proxy advisers). There is therefore an ongoing turnover in the foundation’s underlying investments, and an ongoing dialogue with asset managers and the management of the companies covered by the foundation’s equity fund investments.

Where the global ESG-screened equity funds in which the Carlsberg Foundation invests have investments in companies that do not yet comply with the Paris Agreement, our asset managers will engage with these companies to encourage them to do so, or potentially divest from them.

Investment commitee

The members of the investment committee are: Peter Løchte Jørgensen (chair) Professor, Department of Economics and Business Economics, Aarhus University Niels-Ulrik Mousten Board professional Anne Charlotte Mark Board professional The Carlsberg Foundation has established an investment committee to monitor and advise on the foundation’s investments on the basis of a regularly reviewed investment policy and investment strategy. The committee meets at least four times a year with the Quaestor and the secretariat, and reports to the foundation’s board of directors at least twice a year.